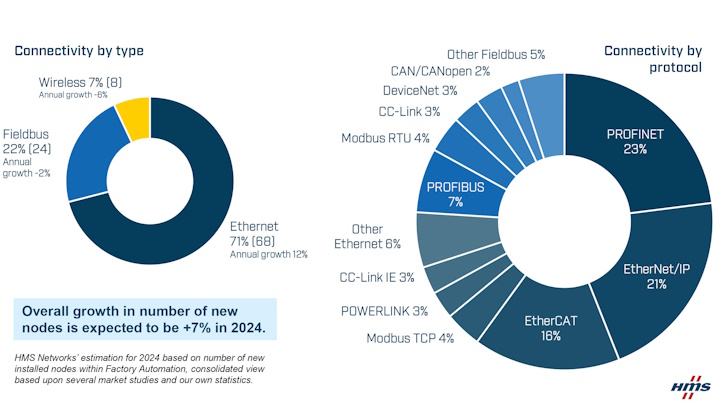

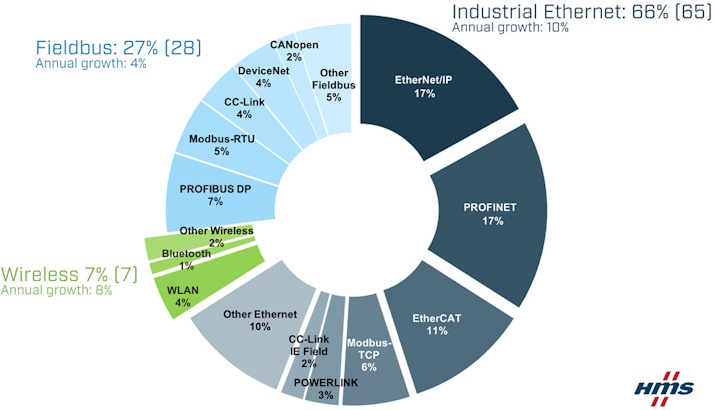

Market shares 2022 according to HMS Networks – Fieldbus, industrial Ethernet and wireless.

Every year, HMS Networks analyses the industrial network market to estimate the distribution of new connected nodes in factory automation. This year’s study shows that the industrial network market is expected to grow by 8% in 2022.

Industrial Ethernet still shows the highest growth and now accounts for 66% of all newly installed nodes (65% last year). Fieldbuses are at 27% (28) while wireless remains at a 7% market share. PROFINET and EtherNet/IP share first place in the network rankings with a 17% market share, but EtherCAT closes in fast, now at 11%.

HMS Networks now presents its annual analysis of the industrial network market, focusing on newly installed nodes within factory automation globally. As an independent supplier of solutions within Industrial ICT (Information and Communication Technology), HMS has a substantial insight into the industrial network market. The 2022 study includes estimated market shares and growth rates for fieldbuses, industrial Ethernet and wireless technologies.

In the study, HMS concludes that the industrial network market continues to grow. The total market growth in 2022 is expected to be +8%, confirming the continued importance of network connectivity in factories.

HMS TechTalks – Anders Hansson, CMO at HMS Networks, comments on this year’s study of industrial network market shares and their evolution.

Industrial Ethernet is growing steadily

Growing by 10%, Industrial Ethernet continues to take market share. Industrial Ethernet now makes up 66% of the global market of newly installed nodes in factory automation (compared to 65% last year). EtherNet/IP and PROFINET share first place at 17% market share, but EtherCAT takes a big leap forward and reaches double digits for the first time at 11% market share. Modbus-TCP is also doing well as it grows to a 6% market share.

Fieldbuses are growing again

Fieldbuses are at 27% market share compared to 28% last year. However, there is an interesting fact behind these numbers as HMS concludes that despite losing one per cent market share, the actual number of installed Fieldbus nodes is expected to grow by 4% in 2022 compared to last year, following several years of decline. The underlying reason is believed to be the fact that factories favour established industrial network solutions in uncertain times such as these due to the effects of COVID-19 and the challenging component situation.

PROFIBUS remains the most installed Fieldbus with a 7% market share, followed by Modbus-RTU at 5% and CC-Link at 4%. Interestingly, the Modbus technologies TCP and RTU continue to be widely used also in modern factories, together accounting for 11% of the market in 2022 compared to last year.

Wireless use cases emerge – the impact of 5G is yet to come

Wireless grows by 8% which is on par with the overall growth rate of the network market, thus remaining at a 7% market share. Typical use cases include cable replacement applications, wireless machine access and connectivity to mobile industrial equipment. The market still awaits the deployment and impact of 5G in next-gen factory automation installations.

Industrial networking is key for productivity and sustainability in manufacturing

“Industrial network connectivity is an absolute key to reaching productivity and sustainability objectives in modern manufacturing, and this is the main driver for the growth we see in the industrial networking market,” says Anders Hansson, Chief Marketing Officer at HMS Networks. “Factories are constantly working to optimise not only productivity and sustainability, but also quality, flexibility and cyber security, and we know that solid industrial networking is key to achieving this as well. While we see growth across all network areas, it is particularly interesting to see that the established Fieldbus technologies are getting back to growth again.”

Regional network variations

EtherNet/IP and PROFINET are leading in Europe and the Middle East with PROFIBUS and EtherCAT as runners-up. Other popular networks are Modbus (RTU/TCP) and Ethernet POWERLINK. The U.S. market is dominated by EtherNet/IP with EtherCAT developing strongly and gaining market share. PROFINET leads a fragmented Asian market, followed by EtherNet/IP and strong contenders CC-Link/CC-Link IE Field, EtherCAT, PROFIBUS, and Modbus (RTU/TCP).

Scope

The study includes HMS’ estimation for 2022 based on several newly installed nodes within Factory Automation. A node is defined as a machine or device connected to an industrial field network. The presented figures represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and our overall perception of the market.

Source: News from HMS